Mark Veldon

London

M&A isn't easy, even if the deal parameters and synergy hypotheses appear superb. Most of us are familiar with the research from Harvard Business Review that stated that 70-90% of all transactions fail, or perhaps have read Robert Bruner's excellent "Deals from Hell" (UVA shoutout!) on M&A failures; but fewer of us may know that even the rumor of a potential transaction can result in significant dips in measurable productivity metrics (sales to employees ratios, gross profit margins, etc.).

One of the most common areas of failure and friction in any transaction occurs during post-merger integration (PMI) - the concrete opportunities to realize synergies and value creation initiatives. Often, we see fault points arise during the handover of a deal thesis from the deal team over to the integration team (if one even exists at a given firm). It is a period that can be fraught with miscommunication and insufficient clarity among stakeholders, resulting in siloed efforts. Usually, the immediate reaction of the functional leads who typically staff the integration team is to laser in on the potential impact on their particular function. It's certainly understandable - the HR lead wants to know how HR can be successful, and the Corporate IT lead wants to know how IT can be successful, but what we often see as a result is a disjointed integration effort and plan to achieve the deal thesis.

Here are a few ideas and guidelines we suggest to better link the deal thesis with integration objectives:

After the deal thesis, leaders need to start thinking about short-term and long-term integration objectives. Some initiatives may require immediate attention, others are areas and efforts that you won't be able to do within a short period of time and will need to be de-prioritized. This is where leadership decision-making during integration shines through.

Every acquisition has a high bar for leadership decision-making, but being able to set strategic priorities to determine short versus long-term integration objectives can really set M&A leaders apart. Too frequently, we see leaders that seem to mandate that every objective is short-term, immediate, and critical to integration success. But by failing to demand strenuous prioritization of objectives, integrations devolve into a morass of peanut-buttered initiatives with little direction as to which are truly critical within the first 100 days.

Any PMI leader is going to have a lot of disparate functions across their respective organizations, but too frequently we see that they remain siloed, and information is being pulled up from the functional teams to the integration management office (IMO) rather than pushing down guidance from the IMO to the functional teams.

To better link the deal thesis to integration objectives, we recommend an IMO that actively sets goals as related to wider objectives, participates in key project activities, resolves issues, and acts as senior management’s surrogates in leading the overall program.

At a basic understanding, we recommend integration leaders track three types of metrics:

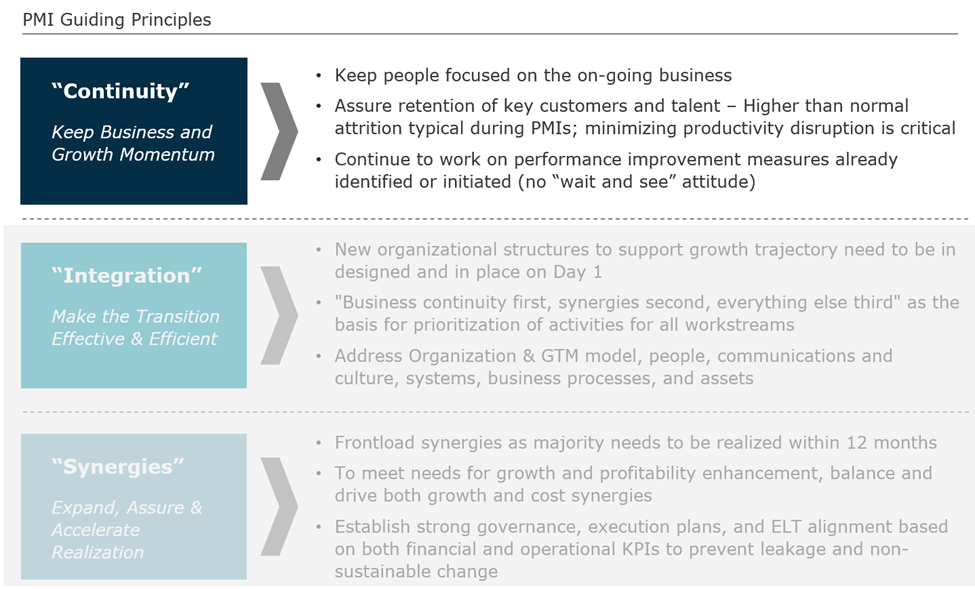

Any integration will require a daunting degree of effort and coordination across the newly combined companies, and far too frequently we see these complex activities siphon attention away from running the day-to-day business. Seasoned integration teams are well-aware of the importance of balancing the business-as-usual commitments with ongoing integration activities; and will frequently echo AlixPartners' flagship PMI principle of “Continuity” as key to their ongoing success. It’s too easy to lose the forest for the trees during integration.

Source: AlixPartners

Successful integration teams need to define how the populations of both companies are going to perceive the integration. Companies must consider cultural alignment in the PMI process, and they should capitalize on the natural inflection point that it creates to do so. In a sense, deals give management a window of opportunity to reset and reorient the soon-to-be combined organization around a new, unified purpose and narrative to ensure that the company emerges with a re-engaged workforce - provided leadership thinks through this process systematically and proactively.

Management teams will need to consider how the two organizations will mesh and how each population might see the integration roll out from their perspective (which can vary drastically). They will need to weigh such considerations as to whether the two companies are global or have workforces concentrated in a particular country (in which case organizational cultures can be more ingrained and specific). Management will also need to consider whether the companies involved in the deal have long legacies of operations or are in vastly different industries.

Value leakage occurs in deals all too frequently because integration planning often loses sight of the deal thesis. We hope some of these points can be used as guideposts to ensure that the deal thesis is always at the forefront of integration planning.