Nick Wood

London

A rapid rise in reliable alternative energy supply from renewable and sustainable sources can’t come soon enough. The irreversible impact of climate change hangs in the balance, while the geopolitical turmoil of 2022 has only served to rubber-stamp the importance of long-term stability in global energy supply.

Growing energy demands won’t make concessions for any disruption on the road to effective global energy transition – a fact clearly acknowledged by investors and reflected by the strength of M&A activity across the energy storage sector.

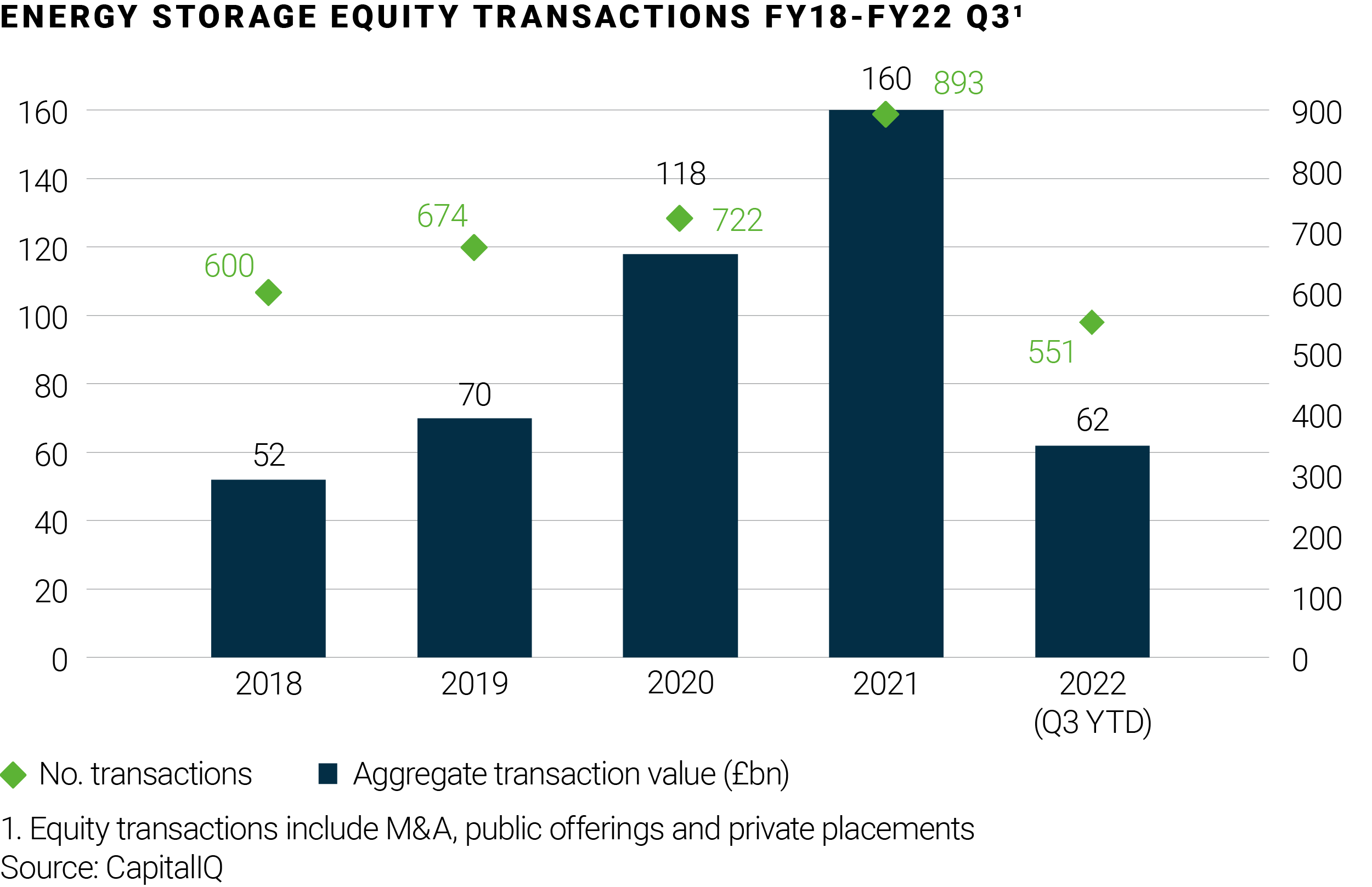

Energy storage equity transactions1 have soared in recent years from a volume and value perspective; with an increase from 600 transactions at an aggregate value of £52bn in 2018 to 893 transactions at an aggregate value of £160bn in 2021. One key element of this intensifying activity has been an uptick in strategic acquisitions from corporates in the sector. Although companies in the wider power and energy space could look to develop capabilities internally, M&A continues to offer a largely superior solution to quickly add scale and capabilities in such a rapidly evolving and growing ecosystem.

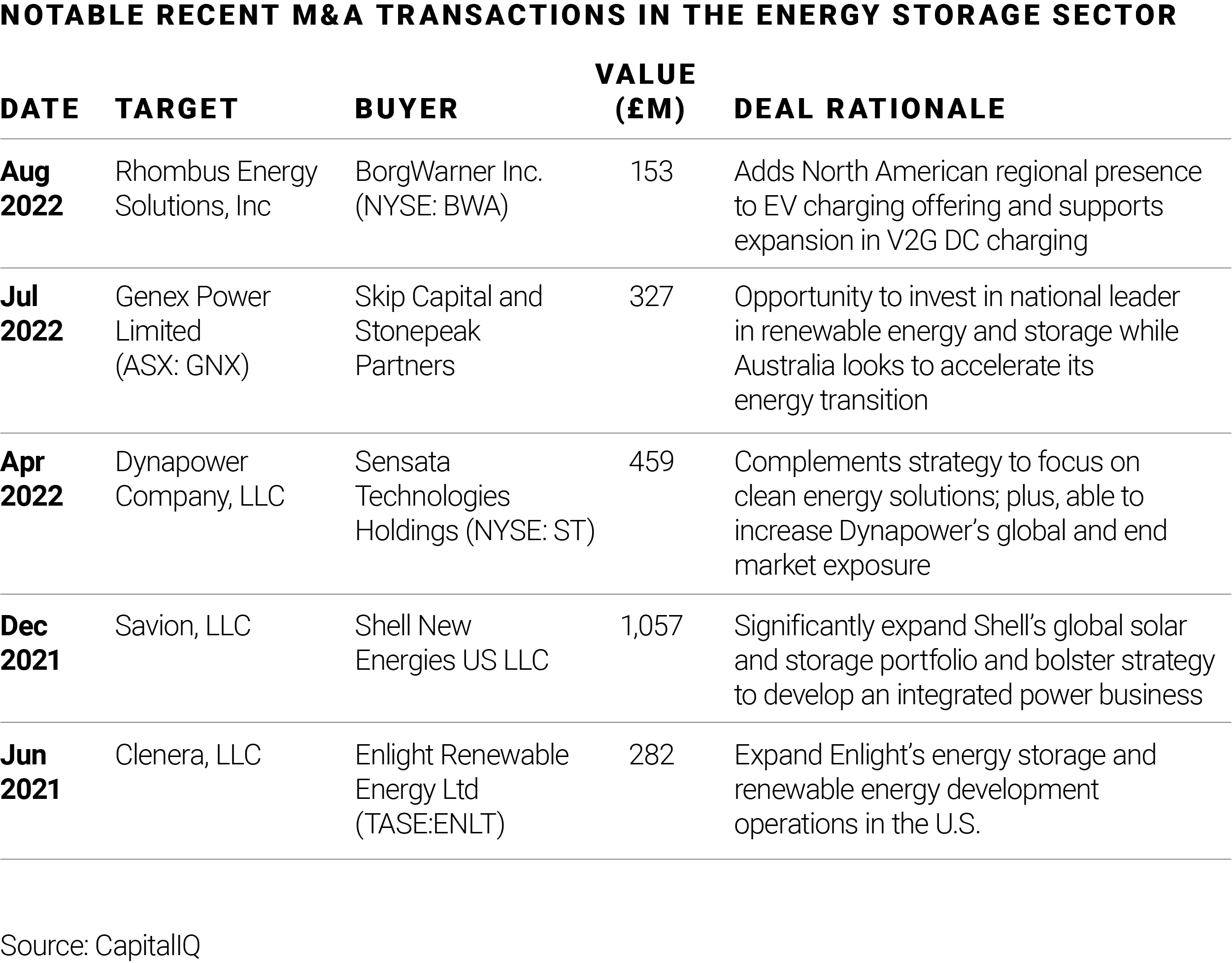

For instance, Sensata Technologies has undertaken several transactions over the last few years, including DynaPower LLC in April 2022 for £459 million, to develop comprehensive energy storage capabilities.

M&A also enables companies to quickly increase operational scale in this growing market. Shell’s acquisition of Savion LLC allowed swift expansion of its solar and energy storage capabilities in the US, which is one of the three largest global markets for renewable energy.

We have also seen a surge in energy storage IPOs in recent year – both traditional and via SPACs – as emerging high-growth companies in the sector seek to capitalise on investors’ enthusiasm for clean energy solutions. One of the most notable IPOs was Fluence Energy (with a valuation of c.$4bn), created as a JV between Siemens and AES Corporation at the end of 2021, which sought to raise capital to support its global growth with its existing owners retaining control.

Cracking the energy storage code

While there is significant investment in renewable infrastructure globally, the variable nature of wind and solar energy poses challenges in stabilising electricity flow and ensuring reliable supply. Coupled with this, curtailment continues to result in inefficiencies and therefore, backup supply is critical to support the shift towards an alternative, reliable and more sustainable energy system.

Companies such as Hitachi Energy’s Grid Edge Solutions division are actively seeking to provide solutions to these grid stability and power quality issues through their automation and intelligent control offerings. One key component of this solution is the capturing and storing of energy from renewable sources (in the form of heat or electricity) to enable supply to be matched with demand as required. It will therefore be of little surprise that the outlook for the energy storage market is strong with a recent Statistista report forecasting the sector’s capacity to grow 35% annually until 2030.

According to Bloomberg, demand for lithium-ion batteries is expected to increase to a mind-boggling 9,300 GWh by 2030, up from 526 GWh in 2020. The rapid escalation in production and supply has also driven a decrease in prices making battery storage a commercially viable solution.

Short-term turbulence won’t budge the long-term trend

There has been a slowdown in transaction activity this year, amid the economic and geopolitical tribulations, with just £62bn of energy storage transactions completed through to the end of Q3 2022, compared to the £160bn of transactions across FY2021.

However, given the robustness of overall market trends and forecasts, this is expected to only be a short-term pause. In fact, there are already notable transactions on the horizon.

For instance, Volkswagen has indicated that it is considering an IPO of its battery unit as early as 2023, for which it has already set aside €20bn for investment.

Investment is expected to continue to pour into the energy management landscape and we expect M&A to remain a critical channel. Corporates will no doubt seek to ramp up scale and capabilities and build their reputation as ‘key enablers’ in the energy transition. Financial investors, meanwhile, will have important roles in deploying the vast sums of capital to help meet the infrastructure demands of building a truly sustainable energy environment.

Watch our interview with Maxine Ghavi, Head of Hitachi Energy’s Grid Edge Solutions business, who shares her insight on the energy solutions market, her company’s revenue and growth opportunities, and why Hitachi Energy turned to AlixPartners to transform their operating model.