2022 proved to be a positive year for the travel industry overall, after the monumental challenges it faced during the pandemic, where domestic and international movement was completely shut down for long periods globally. Strong customer demand, with strong pricing and margins to match, gave travel operators some much needed cheer after the previous two years.

However, it was not a year without its own economic challenges. Travel and hospitality companies had to face into extreme inflationary pressure, high energy and labour costs, and labour shortages. The much publicised "cost-of-living-crisis" has seen consumers cut back spending in a number of areas, leaving travel operators questioning what their customers will do in 2023.

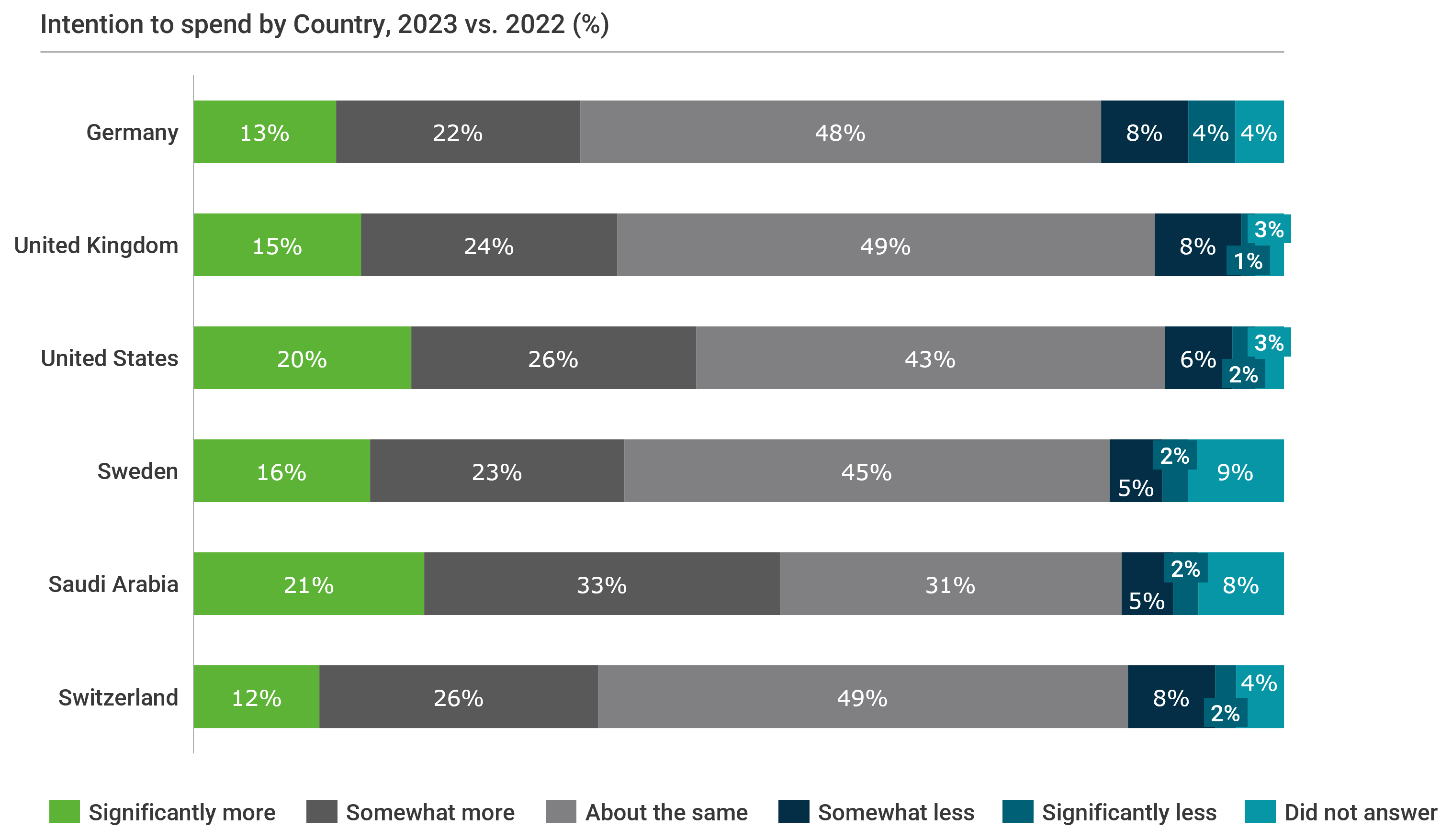

Against this backdrop, AlixPartners surveyed more than 2,700 consumers in 6 countries (UK, Germany, US, Switzerland, Sweden, and Saudi Arabia), to understand how consumers were intending to travel in 2023, whether their travel habits had changed since COVID, and how much of a role ESG was now playing in their travel choices.

EARLY YEAR INDUSTRY INDICATORS ARE STRONG

Operators were uncertain at the end of 2022 regarding how much consumers would cut back on holiday spending this year. However, the high levels of demand seen during January’s peak booking period in the UK will have come as a very pleasant surprise for the sector. A number of UK travel agents and operators reported record trading days during January.

Our research indicates that this may not be a ‘flash in the pan’ that will drop off through the remainder of 2023. Around 45% of consumers told us they were planning to spend “about the same” as they did in 2022, while a notable 41% told us they were planning to spend either “somewhat more than” (25%) or “significantly more” (16%) than they did last year. This response held broadly true across all socio-economic levels. Of those planning to spend more this year than in 2022, ~40% told us they are planning on spending 10-20% more than last year, and about a quarter plan on spending 20-30% more than in 2022.

TRAVEL AS PLANNED – DESPITE THE HIGHER PRICE TAG?

Travel cost inflation does not seem to have significantly dampened consumer intent to travel. When asked what they would do this year if similar 2023 travel plans were more expensive than last year, 57% said they would “travel as planned”, while 29% said they would adjust their plans to match 2022’s costs. Just 10% of respondents would change their travel plans to spend less than in 2022, and only 4% stated they would not travel if their plans turned out to be more expensive than 2022. This response was similar across age groups, with a greater propensity for those over 55 years of age to travel as planned, and those under 55 to adjust their plans to get closer to 2022 costs.

It certainly appears that consumers still have the money to spend on holidays, prioritising these activities over other discretionary areas. Our hypothesis is that many people may still have some savings held back from COVID and may have also saved further up for large purchases such as new cars or moving home. However, with the recent interest rate rises, a spike in new and used car prices, and the long waiting lists for new cars, many people may have decided to forego these purchases, preferring to switch their spending priorities to leisure experiences. This is echoed recently in The Financial Times, which noted that consumer spending on travel and eating out at restaurants in the US has soared by 24.2%.

PANDEMIC BEHAVIOURS ARE ROLLING BACK

Perhaps one of the biggest surprises this January has been the level of demand so early in the year. In the past three years, persistent uncertainty over travel and ever-changing associated restrictions resulted in booking curves becoming very short, as consumers waited as long as they could to book to try to ensure some certainty over their travel plans. In fact, many operators have expressed to us the belief that consumers may never return to booking as far in advance of travelling as they did pre-COVID.

The strength of January trading, together with our research indicates, however, that consumers may be reverting to their original pre-pandemic booking behaviours. Our research showed that prior to COVID, half of consumers typically booked 4 months or more before travelling. In 2023, this pattern is mirrored, and such a return to an extended booking curve will be welcomed by operators, who will gain far greater clarity over performance, cash flows, and operational planning throughout the year.

With these findings, travel operators could expect consumer demand, booking patterns, and willingness to spend to be at least the same as or stronger than what we saw in 2022, with January’s buoyant booking trends perhaps a sign of things to come for the rest of 2023.

The pandemic forced an entire industry and its global customer base to be mothballed, raising questions over a “new normal” that might take shape when the world was in motion once again. Today, however, it seems that travel and leisure experiences have emerged stronger than ever, as a fiercely protected discretionary pastime, despite the potentially higher price to pay during an economic downturn.