For the last 20 years, telco growth ambitions have largely failed or faded over time. To make matters worse, digital natives piggybacked off operators’ hefty investments to reap the rewards. “The telecom industry has a truly compelling history of initial value creation in communications services and systems,” said former President of Bell Labs Marcus Weldon, “but equally has almost as impressive a record of subsequent value migration and loss.”

New telco revenue opportunities are coming into play, such as 5G. In the U.S. alone, operators spent nearly $100B in 2021 purchasing 5G spectrum at auction (FCC Public Reporting System, Completed Auctions). Telcos are spending even more in the network rollout process.

Operators are at a crossroads. In order to prevent value loss and migration, they need to be aware of increased competition in core connectivity markets and resulting margin pressure, as well as increased interest rates compounding debt and development costs for network rollouts.

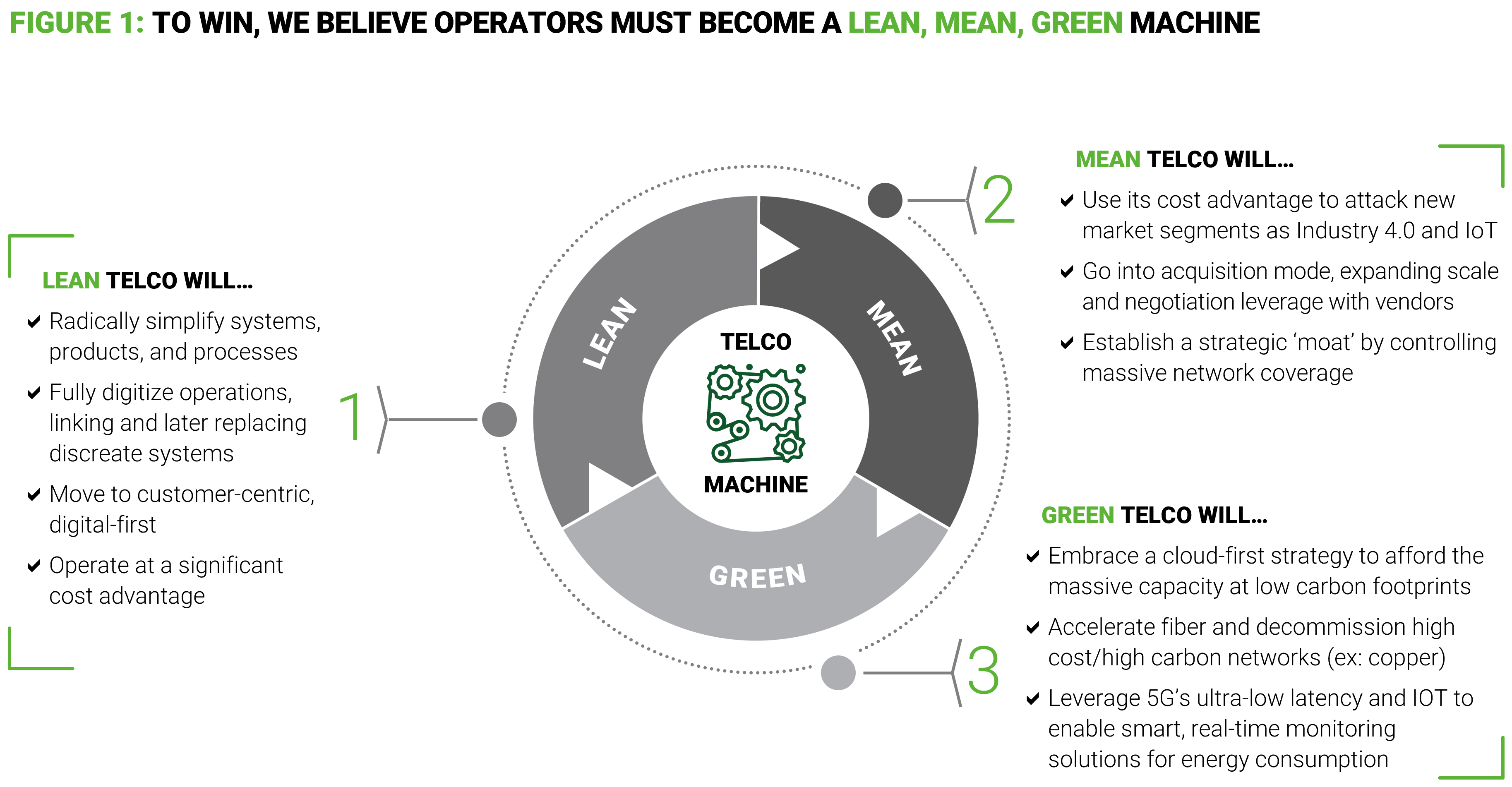

We believe embracing three pillars will lead operators to success:

- A well-grounded cost position—LEAN

- A shift to “attack mode”—MEAN

- An ESG-forward culture—GREEN

In other words, becoming a “lean, mean, green telco machine” will drive economic value.

Getting lean is the first step

Lean telco emphasizes product, process, systems, and infrastructure simplification. It’s the foundation that cleans up the operations and organization to create a streamlined machine.

A simplified, customer-focused product offering allows for end-to-end digitization. In this model, contact centers powered by thousands of humans, or dozens of points of sale in a city, become a thing of the past as customer experience transforms to be digital-first.

Generative AI

is already here. Companies are using this technology to disrupt both the front-line customer experience and enable new ways of thinking about back-office operations

AT&T, T-Mobile, and other operators slashed hundreds of stores in the pandemic due to lower foot traffic and customer preference for online shopping. Is the next step further reducing store count, or setting up one experience center and going completely virtual? This is a prisoner’s dilemma for operators—one they need to break to succeed in the new margin pools.

The only way forward is to shed layers of legacy products, systems, and processes, even if operators will lose customers and certain product markets in the process. Creating a lean, digital-first operation that functions at a fraction of current costs, delights customers, and instills a decisive culture will fuel new growth

Mean telco: back to attack

Mean telco focuses on strategic growth vectors and a win-now approach. These vectors include:

- Providing connectivity services to B2C and B2B customers, by stealing market share from—or acquiring—other operators.

- Expanding into adjacent opportunities, such as content, managed services, or diverse platform offerings.

- Expanding into net new markets, such as banking, smart metering, energy, automotive, or healthcare.

As an example, consider the emerging private wireless networks sector. One might think traditional operators would own this space, but instead, original equipment manufacturers (OEMs) and cloud players such as Amazon, Google, and Microsoft are aggressively gaining market share.

To get mean and capture this market, telcos need to emphasize the value they can provide that OEMs and tech companies cannot. Operators have decades of experience managing networks and can serve as a one-stop shop offering network design, installation, and management at a price competitors can’t match. They also maintain high levels of trust around data security, which the tech players lack.

Going further, operators can generate additional revenue by setting up a platform to own the APIs that power the IoT ecosystem. The faster operators act, the better they will be able to accelerate market share gains.

Green telco conserves resources

As energy costs increase, telcos are focused on energy efficiency. Two key levers operators can pull to reduce energy consumption, and therefore boost EBIT, are:

Network modernization:

Replacing copper cables with fiber in fixed networks is 85% more energy efficient, while 5G networks—which are 90% more efficient in energy consumed per byte transferred than 4G— continue to expand. The ECO-RAN system developed by Palantir helps operators tackle consumption challenges through data-driven decisions that reduce carbon emissions and power usage (up to 15% per site in your network).

Cloudification:

Operators spend significantly less energy per byte transferred via cloud computing—different studies estimate 20 to 70% savings. It’s also far more cost-effective than managing your own data centers. Power usage effectiveness is core to every cloud provider, whereas operators focus primarily on their networks. Outsourcing non-core items or business catalysts simplifies your business by removing inefficient legacy processes, unleashing your AI and machine learning capabilities on what really matters.

We have identified additional levers that operators can pull to become lean and green, resulting in cost efficiency:

An unexpected finding we’ve seen with our clients in the telco space can drive further value. Employee engagement around environmental issues is a source of direct savings, helping drive down energy costs. But perhaps more importantly, it’s also a huge driver of pride and satisfaction in working for a company that “does good”.

Looking ahead

“Lean, mean, green” is as much an operational and systems transformation as it is a cultural mind shift towards a new future.

Operators cannot allow digital natives to reap the rewards of their investments, as happened with 3G and 4G. They can take the lead by transforming into a “lean, mean, green telco machine”—driving the market rather than watching from the sidelines.

Stay tuned for future publications in our "lean, mean, green telco machine" series.