Deb Rieger-Paganis

New York

WHAT IS IN STORE FOR BACK-TO-SCHOOL, THE HOLIDAY SEASON AND BEYOND AND HOW RETAILERS CAN WEATHER THE STORM.

As retailers head into the back half of 2023 and start to build inventory for back-to-school and the holiday season, the erosion of consumer purchasing power is finally starting to have a major effect on revenue and gross margin. This will accelerate the operating margin compression, with a profit structure that is already challenged by over two years of product, cost and labor inflation.

These headwinds became evident during first quarter earnings announcements for many publicly traded retailers and the subsequent downward revisions to both revenue and EPS estimates by sell side analysts. Based on our analysis, year-end 2023 revenue estimates declined by 2.8%, on average, versus the previous guidance provided in February. This revenue decline translated into a 26% average decline in EPS estimates due to cost increases and operational deleverage.

Not surprisingly, discretionary retailers experienced the sharpest declines, while food and consumables held up.

We expect the revenue and gross margin pressure as well as operational deleveraging to continue well into FY2024, given our analysis of the key leading economic indicators that affect consumer purchasing power. This will further complicate the operating environment in an industry that is already facing significant strategic disruption.

Here are key metrics supporting the expected top-line contraction due to consumer pull back:

1. Real wages are decreasing despite the Federal Reserve’s progress on curbing inflation. Real wages have continued the year-over-year decline for 26 consecutive months, a sign that inflation is rising faster than income growth. The biggest impact is seen among middle- and lower- income households.

2. Household debt continues to expand at a breakneck pace, up 7.6% in the first quarter of 2023. Household debt balances, which totaled $17 trillion at the end of March, have increased by $2.9 trillion from pre-pandemic (December 2019) levels. By comparison, household debt totaled “only” $12 trillion heading into the Great Recession in the fourth quarter of 2007. We expect increasing unemployment, sustained inflation, rising mortgage/credit card rates (up over 400 bps and 500 bps, respectively, since late 2020) and the end of the federal student loan payment pause this fall to affect the consumers’ ability to service their debt obligations and to crowd out spending on discretionary retail goods.

3. Savings as a % of disposable income continues to decline from pandemic peaks. During the height of COVID, consumer savings peaked at a historical 33% of disposable income, as consumers hunkered down on spending and received massive government stimulus payments. Since March 2021, the ratio has fallen sharply to 4.1% in April 2023 and is well below its 10-year average of 8.3%. We expect savings to further erode as prices for food and other essentials continue to rise at a greater rate than core inflation.

4. Retail foot traffic trends have turned negative. As savings erode, we are seeing retail traffic and associated spending decline. After a strong start to the year, retail traffic has begun to slow. Placer.ai's quarterly index of retail traffic indicates that overall retail visits fell 4.2% year-over-year during 1Q23. While discount and dollar stores saw modest year-over-year growth of +2.2%, more discretionary subsectors such as malls and superstores saw declines of 3.1% and 4.1%, respectively. Moreover, our channel checks indicate that soft lines and specialty retail foot traffic has declined double digits over the past 6 weeks.

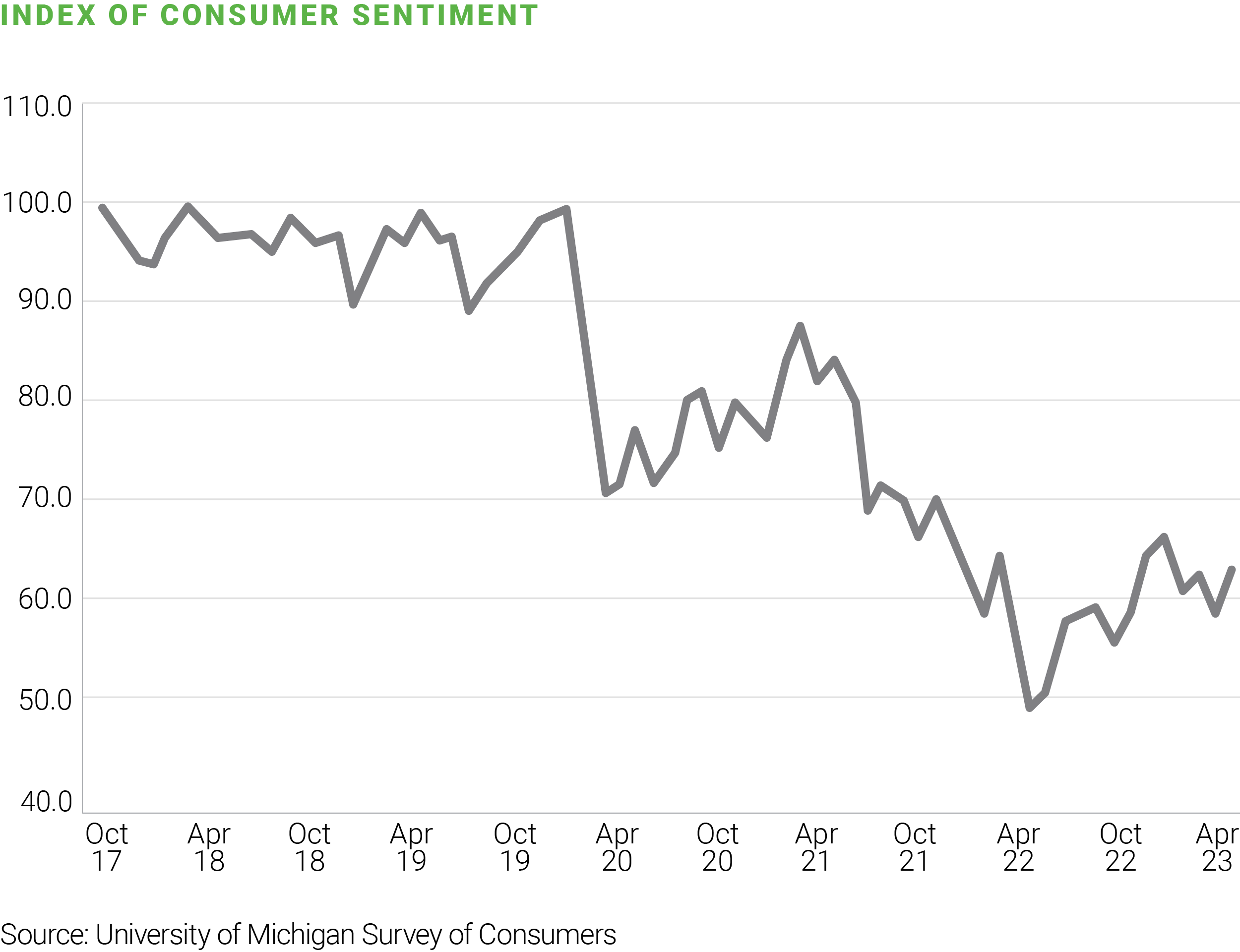

5. Consumer sentiment has fallen significantly as inflation expectations become embedded. In its May 2023 survey, the University of Michigan Consumer Sentiment Survey found that consumers’ long run inflation expectations increased to 3.2%, the highest reading since 2011. Current sentiment readings are hovering around 60 as compared to a pre-pandemic 101 in February 2020.

Some of the most readily available statistics show cost pressures building, creating a margin squeeze for retailers:

1. Average nominal hourly earnings are increasing at rates well above historical levels. Since March 2020, such wages have accelerated to a +4.8% Y/Y monthly rate vs. +2.5% Y/Y during the preceding 15 years.

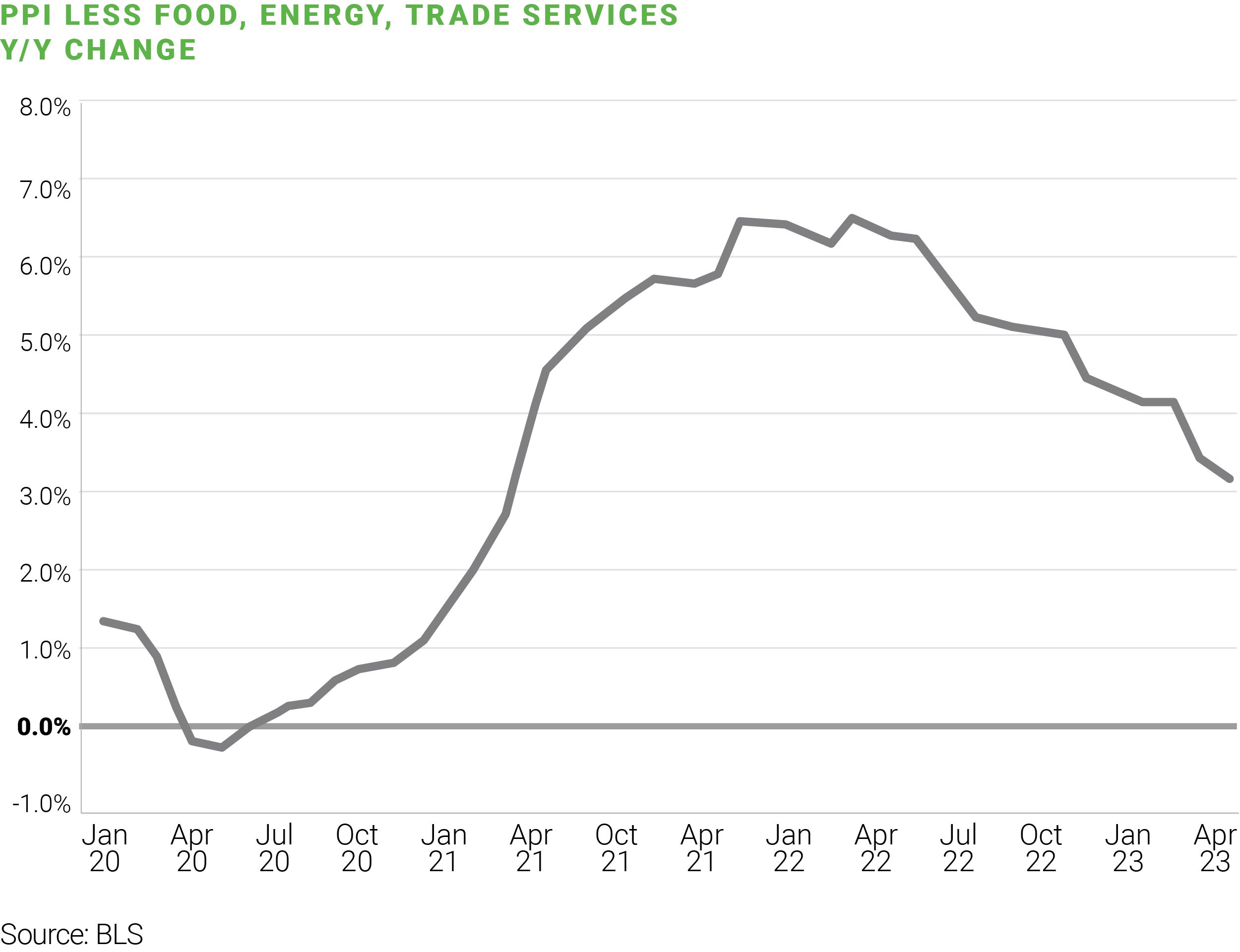

2. Input cost increases are moderating but remain elevated. We expect product costs, combined with a weakening consumer, to weigh on gross margin performance. Importantly, while cost increases are moderating, we believe the ability for retailers to pass on such costs by taking price increases will wane in coming quarters. That playbook will no longer work.

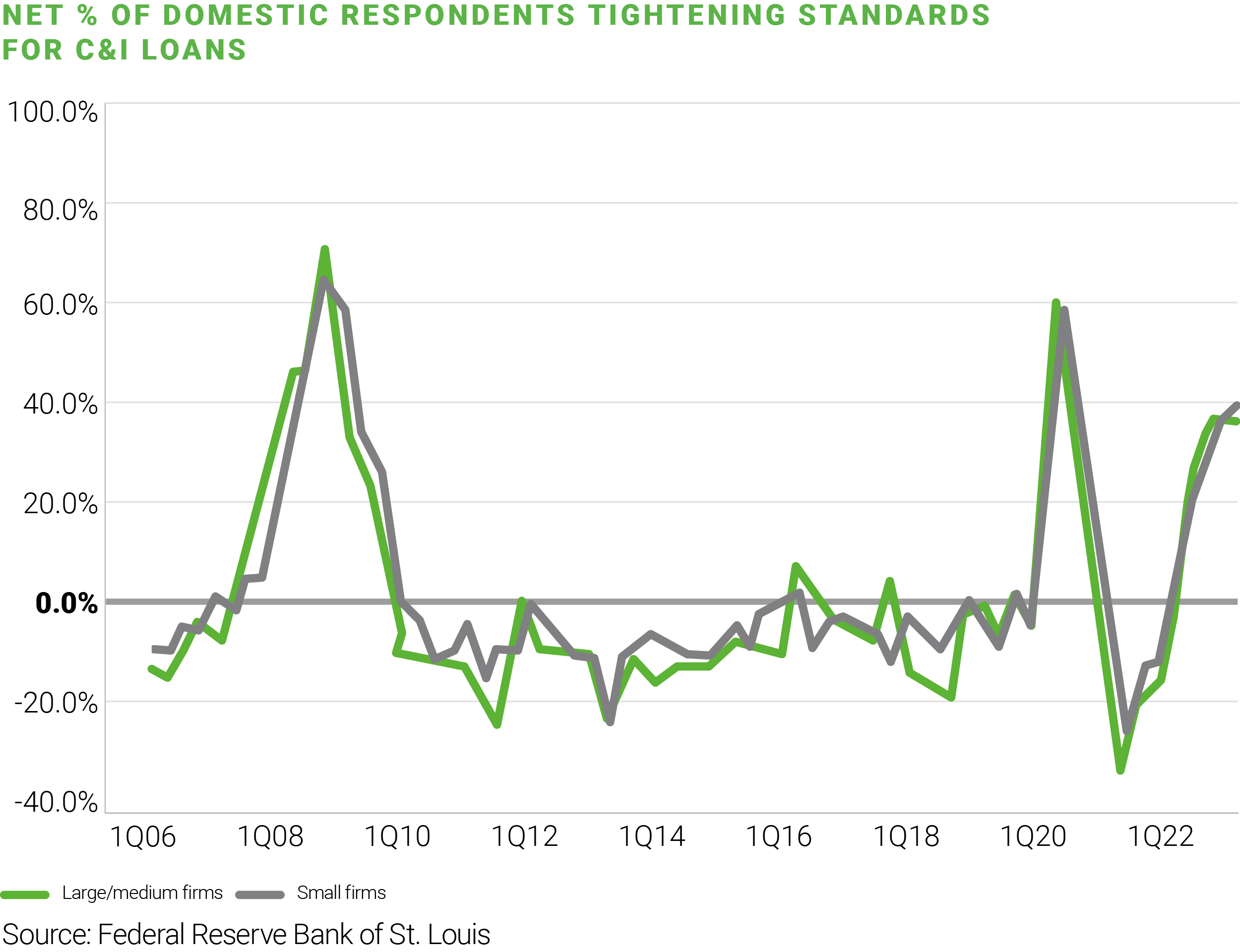

3. Lending standards are tightening, further increasing the cost of debt and constraining access to capital. According to the Senior Loan Officer Opinion Survey, the extent to which banks are tightening lending standards has risen dramatically over the past four quarters. Our conversations with lenders are consistent with these survey results; we are increasingly seeing alternative and more expensive sources of capital looking to fill the funding gap.

How do retailers win in this environment?

With the commencement of the liquidations of David’s Bridal, Tuesday Morning, and Bed, Bath and Beyond in May, it has become clear that winners and losers are already emerging, as we head into fall and the all-important holiday season. The winners should be able to quickly pivot to initiatives that preserve shareholder value, manage risk, and meet the changing needs of the customer.

When the consumer is stressed and the economic future is uncertain, the winning retailers will have a road map to proactively address the four points above. Retailers that take no action will likely end up reacting to events as they unfold, just as consumers hit the wall. These retailers will lose either market share, margin or both.