Mark Wakefield

Detroit

Recently we showed the media some of the “tip-of-the-iceberg” highlights of our otherwise internal and client-focused Global Automotive Outlook, a synthesis of the best insights from our global team’s work through the year and covering everything from a financial analysis of suppliers and automakers to our view on the biggest trends likely to impact the industry.

If you’ve seen any of our press coverage, a lot of headlines have been along the lines of “ICE Is Melting” (so you’d better be ready), “Suppliers’ and Automakers’ Fortunes Have Flipped” (with tailwinds for suppliers and headwinds for OEMs), and “China, Laboratory of the Auto Industry” (where we talk about the winning operating model for NEVs in China looking like a template for the West as well).

Here is a brief explanation of what we mean by the “China-as-laboratory-for-the-world” insight:

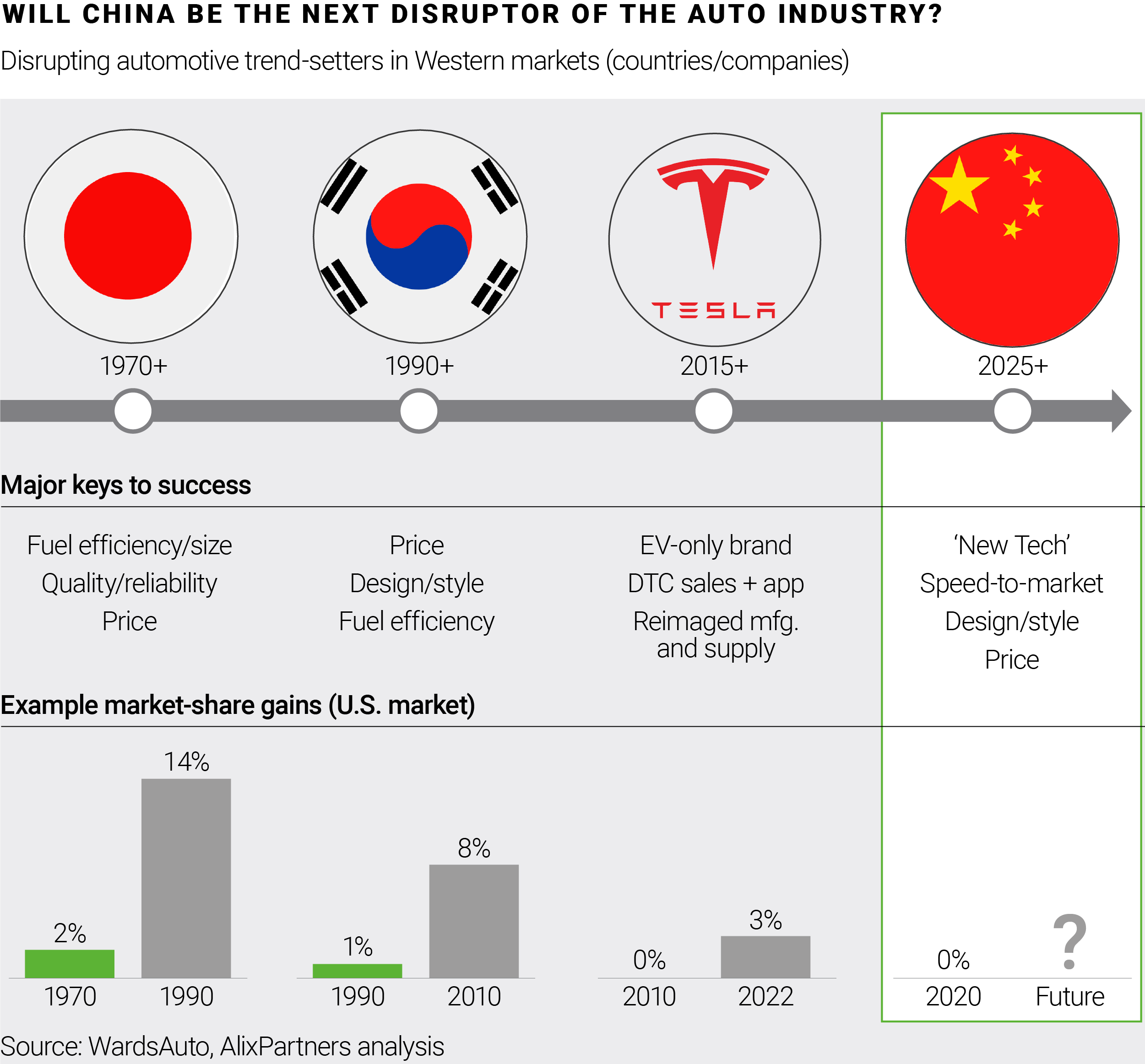

Chinese companies became the world’s largest exporter of light vehicles in the first quarter—and our Outlook forecasts that will continue for all of 2023. Which leads to the question: Will China be the next major disruptor of Western markets, the way many Japanese companies were, then some Korean companies, and, more recently, Tesla?

Today, the export market is not critical to Chinese OEMs, due to still-sizable growth in China itself. However, Chinese brands are now more than 50% of the market in China and have overwhelmingly focused on electric vehicles, beating out the traditional OEMs handily. What’s their recipe for success? For one thing, Chinese-brand OEMs are much better than non-Chinese ones at delivering what tech-savvy Chinese consumers most want. For instance, our analysis finds that the penetration rate for ADAS (advanced driver-assistance systems) is higher for Chinese brands in all price segments, including being 42 percentage points higher in the all-important low-price 80-to-120 RMB price segment.

Fresh and daring design is another reason, and our Outlook finds that Chinese models today are 2-3 years fresher than non-Chinese brands, and that China electric-vehicle brands are averaging only 1.3 years on the market. Their emphasis on “New Tech” technology (everything from ADAS to virtual prototypes) and speed-to-market, plus on exterior styling and interior appeal, is taking precedence over attributes traditionally thought of as “must-have” differentiators by traditional companies (things such as NVH refinement and comfort and power).

We believe that for traditional automakers and suppliers to be competitive in the future, they need to start adopting the ruthless prioritization demonstrated by winning Chinese companies—such not being willing to sacrifice speed-to-market for product refinements that can be overcome by “wow” features.

Even if Chinese imports aren’t arriving en masse in your home market tomorrow, you really should look at the operating models winning in China today regarding design, manufacturing, direct-to-consumer sales, customer engagement, and organizational styles as a wake-up call—to disrupt yourself before you get disrupted.

If you’re an automotive- or related-industry executive and would like a deep-dive, personalized review of the entire AlixPartners Global Automotive Outlook, please click here.