For well over a year, we have been discussing whether or not the global or regional economies will enter a recession.

Now we know that the E.U. entered a technical recession over the winter. Growth in China remains anemic, and producer prices there fell 5.4% year-over-year in June—a bad sign for its economy but potentially a bright side for others around the world still fighting inflation. Indeed, based on the most recent data, the U.S. seems to be bringing inflation under control. In addition, consumer spending, buoyed by continued strong hiring, has kept the U.S. and U.K. economies afloat for now.

The view from the C-suite seems less rosy, though. As we move into a new quarterly earnings season, analysts predict that the S&P 500 will see its third consecutive quarter of declining profits. Insolvencies in the U.S. and the U.K. are at their highest points since the financial crisis over a decade ago. Lingering inflation and higher interest rates are bound to eventually hit consumer—especially discretionary—spending.

For my part, I am watching closely the cost and availability of capital, particularly at the corporate level. After four decades of effectively falling interest rates and the real cost of capital, recent rate increases have been a true shock to the system. Of course, if unemployment spikes and we see growth slow further, central banks may move back into a quantitative easing mode. However, to me, this seems unlikely in the short to medium term.

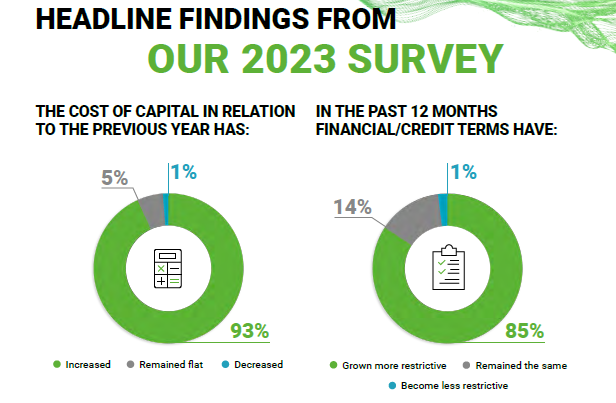

In our 18th Annual Turnaround and Transformation Survey, we surveyed over 700 global experts who worked with troubled companies. The primary challenges this group sees over the next 12 months is precisely this issue—higher interest rates and access to capital. Troubled companies are of course only one piece of the overall economic story, but they are a leading indicator of stress in the system.

Lenders—both in the banking and non-banking sectors—have become more risk averse, and even when willing to lend, their terms are more restrictive. And as we learned in 2008, constricted lending reverberates throughout the real economy.

What should all business leaders be doing in such an environment? We outlined many of these steps recently in an article in the Harvard Business Review and they remain urgently relevant:

- Focus on cash. When uncertainty reigns, cash is king. Build working capital management initiatives into your current plans. Viable, sustainable financing options will need to address all timing considerations and be underpinned by cash flow analysis. Get as specific as possible about how much cash each decision should save or generate, then carefully monitor your progress.

- Understand scenarios and their related risks. Plan for multiple economic futures. Know what levers you can pull to act fast under different scenario alternatives. Review these pathways on a regular basis to ensure they still feel appropriate based on evolving economic conditions and iterate as needed.

- Drive proactivity and agility on cost. Visibility into input costs has never been more important, as volatility has skyrocketed in recent years. Luckily, the tools to map those risks have never been better, and the ability to control those risks throughout the supply chain and cost structure has never been stronger. Building and strengthening these muscles through better analytical and predictive tools is essential.

- Chart a path for transformative change. Longer-term disruptions—from climate change to geopolitical instability to new technologies like generative AI—will not disappear as you manage through shorter-term challenges. Strategies to protect margin and cash flow in the face of inflation, higher interest rates, and reduced funding are essential. However, keeping your eyes on the long-term direction of your business—looking at changes to customer behaviors, new technologies, and competitive dynamics—remain top priorities.

The CEOs I talk with agree: we are living in a more uncertain and unstable world. The funding environment is only part of that instability, but one which impacts every part of the business. Learning—or relearning in many instances—to operate in a higher cost of capital environment is an urgent and essential task for every business executive.