Marc Iampieri

New York

In an era marked by the intricate web of global supply chains, organizations have leveraged the fourth-party logistics (4PL) operating model to drive efficiency coupled with flexibility in an effort to meet the ever-evolving customer demand. Many of our clients have partnered with 4PLs in recent years for a host of reasons, and this article shares our perspective on what to look for and how to establish such relationships when considering transitioning to this type of model. It also provides a structured framework to interested practitioners that highlights key elements to look for in this field.

Defining the 4PL model: a tale of two parties

A 4PL represents a non-asset-based logistics services entity. Operating as the single point of contact, it manages and orchestrates all third-party logistics providers (3PLs) on behalf of an organization. This strategic relationship enables organizations to concentrate on their core business activities, leaving the intricate management and coordination of logistics operations to the 4PL.

That said, the services managed in this model can encompass an array of activities such as contract negotiations, 3PL onboarding, performance management, warehousing, order fulfillment, transportation, freight auditing, and payment processing.

Beyond these operational aspects, 4PLs also offer a broad approach to supply chain enhancement, supporting, for instance, warehouse network optimization, inventory management, load consolidation, and route optimization, to name a few areas. It's important to note that these types of relationships vary in structure, with some large 3PLs also offering 4PL solutions as part of their service portfolio, constituting a nuanced and potentially complex field when it comes to labeling companies and services.

Who are 4PL relationships for?

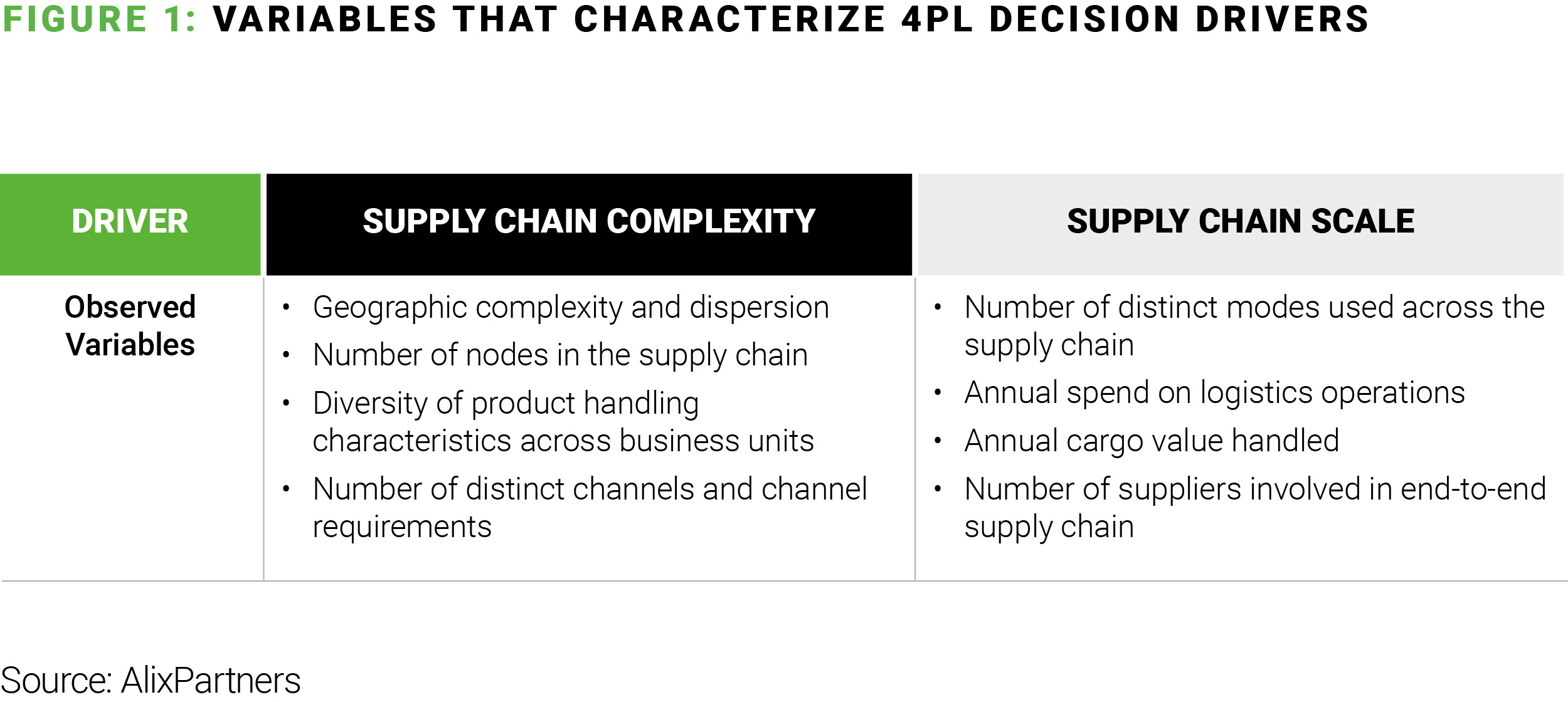

To understand when a 4PL strategy is most appropriate, two decision drivers are fundamental in our experience: supply chain complexity and supply chain scale. Each of these drivers has its own set of variables that can help business leaders objectively define if their organization should pursue a 4PL model and how (see Exhibit 1).

Complexity often arises from geographically dispersed operations, an extensive network of supply chain nodes, diverse product handling characteristics across multiple business units, and the need to cater to various channels with distinct requirements. Scale, on the other hand, hinges on the number of transportation modes employed and the annual logistics expenditure.

Both drivers combined tend to be strong indicators of a business that could benefit from 4PL support. Typically, we see the most successful 4PL implementations in environments with high complexity and scale in logistics operations. On the opposite side of the spectrum, we see smaller, less complex businesses often maintaining control and finding success by developing internal capabilities.

The decision difficulty dramatically increases in the middle of the spectrum: companies with high complexity yet medium-to-low scale can swing in either direction (managing logistics internally or seeking out an external partner) as long as the economics are viable, which means the decision-making process becomes more heavily indexed in the financial analysis. Lastly, companies with medium-to-low complexity and high scale typically find success through internal management of activities coupled with outsourcing of transactional tasks (e.g., offshoring selected processes to lower-cost regions of the world, or less expensive areas of the country).

Exhibit 2 showcases the directions indicated above in a matrix format and forms a directional framework to initiate 4PL transition discussions.

Evaluating the pros and cons of 4PL collaboration

When considering a 4PL partnership, organizations must weigh the pros and cons of such decisions. On the positive side, 4PLs allow organizations to focus on their core operations and strategies by handling the complexities of logistics management as well as execution. They may also serve as a single point of contact for multiple 3PLs across the supply chain and around the world, which can potentially reduce logistics costs by leveraging economies of scale. Many 4PL providers, in fact, leverage their expertise, scale, and technical capabilities to specialize in niche markets or particular commodities and effectively become a source of significant value for their customers. Likewise, 4PLs draw upon their extensive experience to streamline operations and enhance supply chain efficiency, adaptability, and visibility, providing, for example, the ability to increase or decrease the capacity over time in particular lanes or regions.

On the other hand, there are costs and risks associated with a 4PL model. These include loss of control over logistics operations and a potentially high setup cost and effort to implement, particularly if there are technological enhancements necessary for the transition, such as TMS integration, visibility, tracking systems, or other type of solution deployment. These costs and risks are part of the reason complexity and scale are such important drivers in this decision: companies with immature processes and technology, IT capabilities, and financial scale to dilute the burden of a 4PL operation will likely feel greater pain compared to larger, more mature organizations. Risks also include the potential bias towards working with a preferred logistics service provider instead of the one best suited for the organization at that particular time, as well as issues around a misaligned compensation structure. Lastly, as relationships come and go, vendor contracts are not perennial. A non-amicable or even litigious breakup with a 4PL provider might lead to a termination that affects costs and service levels as the business needs to suddenly insource logistics operations and rebuild its internal capabilities and systems.

Relationship advice: Selecting the right 4PL partner

Selecting the most suitable 4PL partner involves several key considerations, such as assessing the financial stability of the 4PL provider, matching the scope of outsourced services with customer requirements, evaluating the maturity of the services offered, and examining the provider's experience within the industry. Organizations should also scrutinize the capabilities and past performance of the partners/vendors within the 4PL network and inquire about their track record in managing logistics operations and driving performance improvements. Additionally, the compatibility of 4PL’s technology and data analytics capabilities with the organization's IT platforms must be assessed to gauge implementation complexity. The experience level of the resources assigned to the organization's account is another element that must align with the desired outcomes.

The foundation of a successful 4PL partnership lies in a well-structured contract. This contract typically includes fixed monthly fees and variable fees per transaction, potential costs associated with additional resources, and key performance indicators (KPIs) that cover not only the logistics services rendered but also the management of said services, including cost performance. In some instances, volume commitment expectations could be proposed, and legal mechanisms should be in place to ensure reasonable and reciprocal commitments. Financial incentives or penalties tied to performance outcomes are also important elements of complex agreements, and experienced Procurement managers understand how to best leverage these tools to ensure high service levels and continuous operational improvement. Lastly, we believe it is important to clearly outline and formalize the use of key performance reports and review schedules to ensure transparency and accountability from both parties.

In conclusion, 4PLs represent a strategic avenue for organizations to streamline their logistics operations by serving as the central orchestrator of multiple 3PL providers. While they offer substantial benefits, including cost reduction and enhanced supply chain efficiency, organizations must be prepared to give up a degree of control over their operations. The decision to embrace the 4PL model should be made after a thorough evaluation of an organization's logistics complexity and scale, which are two key drivers we have identified over decades working with players on both sides of this discipline. The selection of a compatible partner and the development of a comprehensive agreement are pivotal to a successful and enduring 4PL partnership, and it is important to always remember that in the intricate choreography of supply chain management, the 4PL song is not a solo dance.