Matt Clark

London

The UK retail scene is setting the stage for a modern-day enactment of Charles Dickens' 'A Christmas Carol,' where the ghosts of Spending Past, Present, and Future lead the narrative amidst a global economic crunch. As Scrooge was visited by phantoms in the night, the retail market too faces its spectres amidst the holiday lights, as revealed by industry data and our new research, The Critical Consumer 2024.

In the narrative of Spending Past, market experts have long echoed sentiments of belt-tightening, yet the resilient consumers often engaged in year-end retail rallies.

UK spending forecast during the holiday period (November-December) is projected to hit £131bn in retail sales, marking a 4% rise on the same period last year – on paper yet another rally. However, when you build inflation into these numbers another tale unfolds – real-term volumes are predicted to decrease by 4.1% (AlixPartners Analysis, ONS).

As the year draws to a close, grocery sales are forecasted to exhibit a pattern similar to the overall inflationary impact, with a significant cost pass-down to consumers. This financial strain is evident as nearly 50% of UK consumers report spending 'more/much more' on groceries compared to the previous year. This increase in expenditure has unfortunately resulted in negative volume growth rates for grocery retailers.

The plot thickens as the ghost of Spending Present takes centre stage, and it seems to be a ‘not-so merry Christmas’ for all. Recent data suggests that we may be re-entering the retail recession that came to an end in Q1 2023, with sales falling 0.8% in Q3 compared to the previous quarter.

Consumers have less money and belt-tightening is the name of the game.

This sentiment is reflected in the recent trading update from M&S reported positive half-year earnings, with pre-tax profits up 75% in H1 2023, however the retailer shared the cautious outlook of many by declining to upgrade full year expectations.

When we asked consumers about their planned spending over the festive period, UK consumers are particularly expressing their belt-tightening on Christmas decorations (30%) and gifts for others (27%) – extraordinarily, even more so than gifts for themselves (26%).

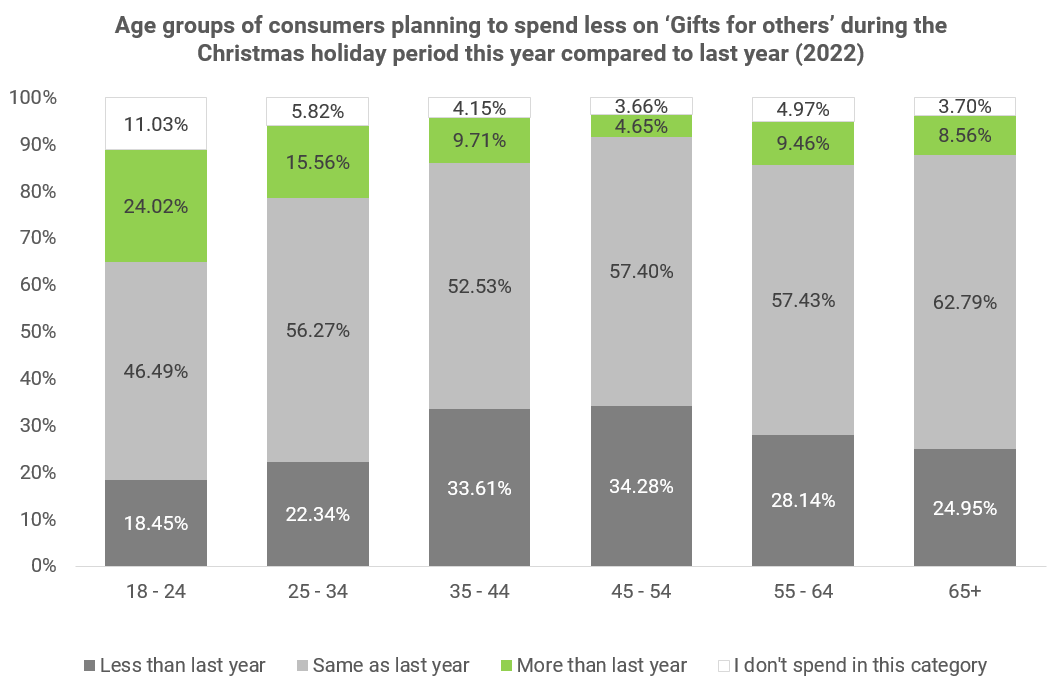

The typically active purchaser during the holiday season - the 35-44 and 45-54 age categories – are the ones that plan to spend less than other age groups on gifts for others this Christmas (34%), indicating that it is families which are feeling the biggest squeeze – therefore it is imperative that retailers appeal to a ‘value for money’ based approach with their messaging – and some of the marketing efforts of retailers seem to be missing the mark when it comes to conveying this message.

The most optimistic age group during the festive period are the 18-24 category, who intend to spend more than any other age group on gifts for others (24%), gifts for myself (16%) and Christmas holiday events/celebrations (23%) – this age category does not seem to be as affected by the current climate and even if they are potentially spending less, they are still intending to spend.

Our analysis across the various income levels reveals intriguing patterns, particularly within two critical sectors during the holiday season: gifting to others and self-gifting. While conventional wisdom might suggest a wider gap in spending behaviour between 'low' and 'high' income groups, the data presents a subtler reality. The difference in the propensity to reduce spending on gifts for others is marginal—just a 7-percentage point spread between the two income extremes (Low income – 30% vs. High income 23%). This suggests a nuanced approach to budgeting during Christmas, where typically the spirit of giving remains resilient against economic pressures.

The notion of self-gifting, often viewed as a luxury, surprisingly transcends income brackets, with a uniform sentiment of 27% across income bands. This presents an interesting conundrum for retailers regarding the perceived availability of disposable income. Despite the expectation of more lavish spending by higher earners, there exists a common mindset across all demographics to seek value and perhaps 'trade down' during the festive period. Such consumer behaviour underscores the complexity of the spending psyche during the holidays, where emotional value can outweigh financial might, and frugality doesn't necessarily equate to a lack of generosity.

Looking at the categories that are the most likely to be affected, discretionary items such as Consumer Electronics (47%) Clothing (46%) and Sporting Goods (45%) are feeling the biggest pinch compared to the previous year, with consumers seemingly trading-off spend against groceries – 49% spending more on putting food on the table reflecting the real impact of high food price inflation over the past year.

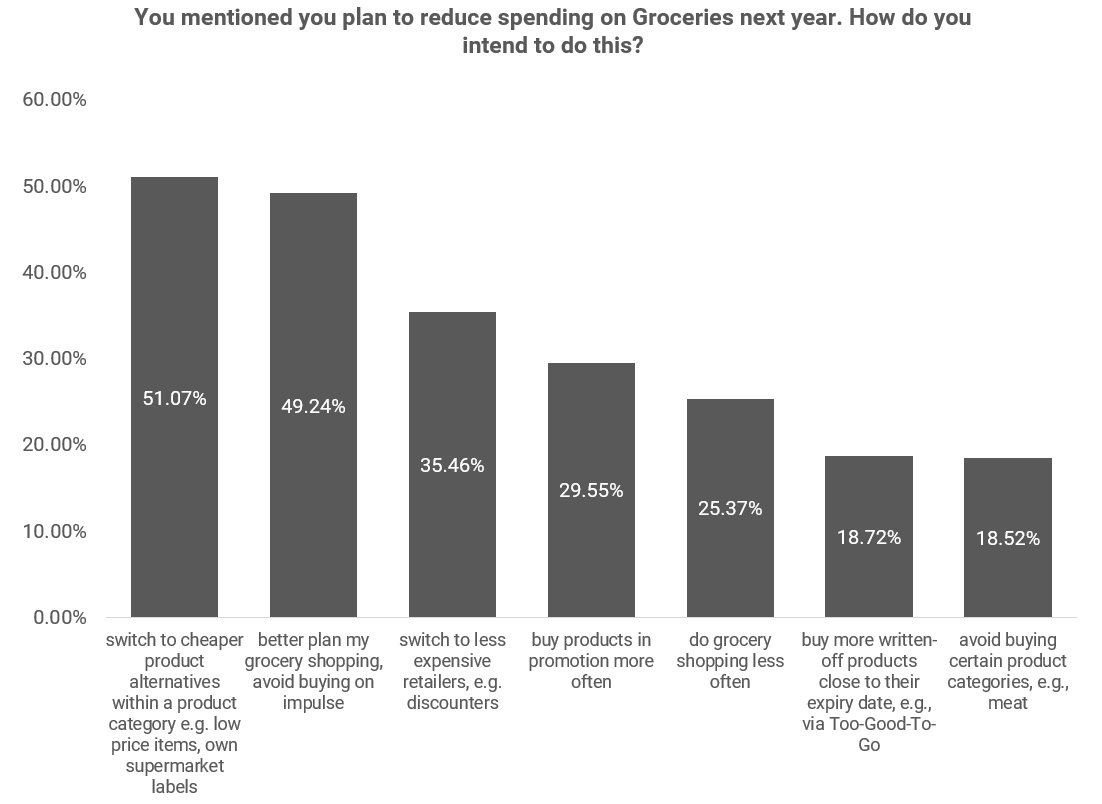

The ghost of Spending Future is a tale of evolving consumer behaviour, with a shift towards more pragmatic spending. A significant portion of consumers are trading down to cheaper alternatives, particularly in essential categories like food and drink, with 51% citing this is how they plan to reduce category spend in 2024. Interestingly, it is those in a ‘high income’ band who are the most likely to switch to cheaper alternatives, including supermarket own brand, with over 60% planning on making this switch. Discretionary spending on items such as homeware is seeing a curtain fall, as over a quarter of consumers plan to cut back on such expenses.

Whilst the picture for the hospitality sector is in less festive spirit this holiday season, with consumers cutting back on spend in out-of-home entertainment (52%) and restaurants/bars (51%), there is cause for optimism within the resilient 18-24 age group, who not only plan on spending the most over the Christmas period (23%) than any other age group, but plan on maintaining, or increasing spend in the restaurant and bar category in 2024 by +11% pts (76%).

The finale of this ‘Retail Carol’ paints a picture of continued caution and future belt-tightening in 2024, with consumers planning to spend less or the same across all categories – a growing concern across the sector, and one where retailers will need to ensure that they need to play smart with their pricing strategies to grow, or at very least retain, share of wallet.

As the next chapter of UK retail sector plays out, retailers should reflect on the lessons of past spending, the reality of the present economic climate, and the hopes and cautions towards future spending – this will shape the market’s future tale.

Our new piece of research, The Critical Consumer 2024 will be launched at the beginning of December, for a first look at the research – get in touch.

Commenting on the Christmas Retail Forecast and new research, The Critical Consumer 2024, Matt Clark, Partner & Managing Director and, EMEA Retail Lead at AlixPartners, said: