Global supply chains are in the midst of major turmoil, driven by an intensifying trade tension and a new wave of tariffs. On April 2nd, 2025, the U.S. Administration announced a significant shift in U.S. trade policy, introducing what he termed the "Liberation Day" tariffs.1 This includes a universal tariff of 10% on all imports from most countries worldwide, a reciprocal tariff that varies by country based on the U.S. trade deficit with each, and de minimis threshold adjustments which eliminate the $800 duty-free threshold for imports.2

On April 9, the U.S. administration announced a 90-day suspension3 of country-specific reciprocal tariffs for all trade partners except China—less than 24 hours after they were implemented. China, however, now faces a tariff rate of 125% (145%4 including fentanyl-related policies), up from the 84% rate that was originally planned.

In response, China announced a 125% reciprocal tariff on U.S. goods on April 11.4 Meanwhile, the European Union suspended its retaliatory tariffs following the U.S. reversal of the country-specific tariff policy.5

These frequent and significant policy changes not only created a significant level of uncertainty in the industry but are also quickly altering transportation patterns and introducing a fresh layer of volatility across all modes of freight. From evolving trade regulations to pricing instability, every link in the supply chain is under pressure.

Transpacific ocean freight: Supply and demand headwinds converge for Eastbound trade contracts

We are observing a decline in both demand and supply on the ocean freight front. On the demand side, booking cancellations are happening across Asia, especially in China. According to an article from JOC,6 carriers and NVOCC have reported a 20-60% drop in bookings for China-origin cargo. So far, the cancellations mostly cover cargos that would arrive in May, but as the tariff policy remains in place, many shippers expect to see the booking cancellations start to affect cargo further out in June.

According to a separate article from MSNBC,7 booking volumes across global and U.S. trade lanes plummeted from the last week of March to the first week of April, with sharp decreases across several categories, including apparel and accessories, and wool, fabrics, and textiles, both down over 50%.

Source: CNBC7

In response, ocean carriers have begun to cancel sailings, although this capacity adjustment has not yet reached a disruptive scale. At the time of publication, a total of 80 blank sailings out of China have been recorded based on a report from MSNBC.7 In an interview with JOC,6 a Port of Los Angeles Executive Director stated that 12 sailings from China to the U.S. West Coast in May have been cancelled due to tariffs.

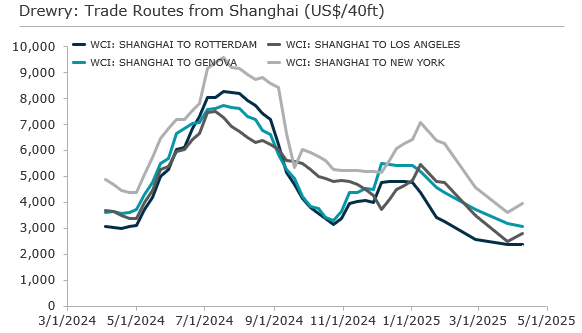

Rates remain relatively steady at the moment.8 As of early April 2025, ocean freight rates from Shanghai to Los Angeles have actually experienced a modest uptick, with spot rates rising approximately 3% to $2,815 per 40-foot container. However, we anticipate rates to trend downward in the near future if demand for volume does not pick up.

Source: Drewry

The most significant long-term shift is in trade patterns. A measurable movement away from China toward South and Southeast Asia is already underway across multiple product categories before the tariff announcement. The pace of the shift will pick up since the announcement. This shift reflects both economic incentives and geopolitical recalibration. In time, we expect increased exploration of alternatives in Latin America and the Middle East as companies broaden their sourcing strategies.

Asia-U.S. air freight: Demand softens amid policy shockwaves

Air freight volumes have continued to grow year over year, however that rate of growth has recently fallen as global trade uncertainty increases.9 Restrictions placed on the de minimis program go into effect on May 2, which looks to have a significant impact on global air freight. An estimated 3% of all global air freight is tied to US shipments from China as a part of the de minimis program.12

While demand remains subdued, we expect volatility to pick up ahead of tariff implementation dates, particularly for certain industrial and consumer goods. There was a short-lived uptick in March, driven by automotive manufacturers rushing to front-load inventory and Apple air freighting an estimated $2 billion of goods from India prior to the tariff deadline,10 but these appear to be a temporary spike rather than a trend.11 Air cargo rates have moderately declined, yet high volatility persists. Shorter-term contracts are becoming more common as shippers seek flexibility amid uncertainty.

U.S. domestic trucking: Pressure building below the surface

While tariffs have yet to materially affect domestic trucking rates, we are beginning to see indirect pressure emerge. A slight softening in freight volumes—especially on long-haul lanes—suggests the potential for rate compression in the near term. Expectations of a long-awaited truckload market recovery in 2025 are waning as rates decline back to the low levels13 experienced in 2023 and any rate increases seen are fleeting.

Source: DAT, AlixPartners analysis

Source: DAT, AlixPartners analysis

At the same time, transportation costs along the U.S.–Mexico border are increasing, driven by longer delays, enhanced inspections, and unclear trade protocols under USMCA for certain goods.

Supply-side constraints are also intensifying. Several smaller carriers have recently exited the market, tightening capacity, particularly for long-haul routes. Industry feedback, such as recent insights shared by Redwood Logistics, confirms these pressures are becoming more pronounced. Tariffs are also expected to impact the supply of US new vehicles, with approximately one-third of commercial trucks being imported from Canada and Mexico.14

U.S. rail: Stable for now, but watching the horizon

Unlike other modes, rail transportation has remained relatively stable. March data shows upward trends in volume for key commodities. However, if manufacturing continues to shift toward North America, we may see changes in the medium to long term.

Of the commodities transported on rail, international volumes to/from Asia, such as intermodal, grain, coal, and automotive, could be affected longer term due to tariffs. It's important to note that 38% of U.S. rail carloads—and 37% of overall rail revenue—are directly tied to global trade, making the sector highly sensitive to any shifts in international supply chains.15 We are also watching for changes in cross-border moves from Canada and Mexico affecting imports that are non-USMCA compliant.

For the second week of April, the AAR reported Canadian rail traffic up 1.1% (showing no signs of impact) while Mexico was down 15.9% versus last year.16

U.S. warehousing: Bonded warehouses are having their moment

There are more headwinds than tailwinds in the warehouse market because of the recent tariffs. In the short term, there may be additional demand to store the glut of goods ordered in anticipation of these tariffs and as companies shift to a just-in-case philosophy. However, the general uncertainties and unpredictability surrounding the tariffs have companies waiting to make their next move.

Coupled with declining consumer sentiment,2 the outlook for the warehouse market is mixed at best. But there is one area that is seeing increased demand: bonded warehouses. These are warehouses where importers can store goods and defer paying duties until the product is sold and removed from the warehouse (for up to five years in the United States). This also gives companies the flexibility to export items from bonded warehouses without needing to pay the import duty. Bloomberg is reporting that demand for these warehouses in the United States has been increasing dramatically. The combination of cost pressure from tariffs and the unique financial and strategic flexibility offered by bonded facilities shows why they are "having their moment" as an essential tool for importers.

Recommendations for shippers

In this fluid and volatile environment, shippers should take a proactive and agile approach to mitigate risk and optimize cost:

Favor shorter-duration contracts to maintain flexibility in a rapidly changing rate environment.

Reassess service levels versus cost, especially as volatility may introduce trade-offs that impact time-to-market or customer expectations.

Secure longer-term rates for secondary sourcing locations, particularly those in emerging or alternative supply regions, to reduce exposure to spot market fluctuations. Since the exact level of tariffs in the future is uncertain, it is important to plan for different scenarios to avoid surprises.

The bottom line

While some disruptions remain muted today, the undercurrents of change are already reshaping the transportation landscape. Shippers that adapt early, by diversifying sourcing, hedging risk through smart contracting, and maintaining operational flexibility, will be best positioned to navigate what lies ahead.

Sources:

Introduction

1. Liberation Day announcement: https://nypost.com/2025/04/02/us-news/trump-slaps-at-least-10-tariffs-on-all-imports-in-declaration-of-economic-independence-half-of-what-they-could-be/?

2. De-minimis rule ended as part of Liberation Day announcement: https://www.theguardian.com/us-news/2025/apr/13/trump-tariffs-fast-fashion-prices?

3. US Administration announced a 90-day suspension of tariff except for China: https://nypost.com/2025/04/09/us-news/trump-pauses-tariff-hikes-for-90-days-against-most-countries-hikes-china-rate-to-125/?

4. Universal tariff on Chinese goods to the 145% level: https://abcnews.go.com/Business/wireStory/tariffs-put-trade-china-us-peril-chinese-businesses-120757320?

5. Europe pauses retaliatory tariffs against US temporarily: https://www.euronews.com/my-europe/2025/04/10/eu-pauses-retaliatory-tariffs-against-us-to-give-negotiations-a-chance?

Ocean

6. Canceled booking and blank sailing out of China: https://www.joc.com/article/trans-pacific-blank-sailings-set-to-rise-after-china-bookings-drop-sharply-5984166

7. Massive booking cancellation and 80 Blank sailing out of China: https://www.cnbc.com/2025/04/16/trade-war-fallout-china-freight-ship-decline-begins-orders-plummet.html

8. Drewry world container index: https://en.macromicro.me/collections/4356/freight/44756/drewry-world-container-index

Air

9. Air Cargo Market Analysis: https://www.iata.org/en/iata-repository/publications/economic-reports/air-cargo-market-analysis-december-2024/

10. Apple airlifts 600 tons of iPhones: https://www.reuters.com/technology/apple-airlifts-600-tons-iphones-india-to-beat-trump-tariffs-sources-say-2025-04-10/#:~:text=Two%20other%20direct%20sources%20confirmed,not%20respond%20to%20Reuters%27%20queries.

11. Tariff causes temporary lift in air volume: https://www.joc.com/article/new-trump-tariffs-spur-rise-in-us-bound-air-cargo-rates-amid-frontloading-5975439

12. Air cargo braces for impact as US restores duties on Chinese e-commerce: https://www.joc.com/article/air-cargo-braces-for-impact-as-us-restores-duties-on-chinese-e-commerce-5976399

Trucking

13. Trump tariff chaos restrains US truckload, LTL markets: https://www.joc.com/article/trump-tariff-chaos-restrains-us-truckload-ltl-markets-5979968

14. Tariffs Impact on Trucking Industry: What We Know So Far: https://www.spglobal.com/automotive-insights/en/rapid-impact-analysis/us-tariffs-impact-trucking-industry#link2

Rail

15. https://www.aar.org/wp-content/uploads/2025/03/AAR-RIO-March-10-2025-FINAL.pdf

16. https://www.aar.org/news/aar-reports-weekly-rail-traffic-for-the-week-ending-april-12-2025/